are raffle tickets tax deductible australia

Ticket number 081455 G of VIC Early Bird Winner. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization.

Are Raffle Tickets Tax Deductible The Finances Hub

M of NSW 707617.

. This is because the purchase of raffle tickets is not a donation ie. Regular Raffle Supporter Winner. Please use the ACNC Charity Register to determine if a charity has received DGR approval.

Generally you can claim donations to charity on your individual income tax returns. What you cant claim. Funds that are donated in exchange for benefits such as raffle tickets gala dinners or prizes however genuine are not tax deductible.

You can claim up to 10 for coin bucket donations without needing a receipt. In accordance with Australian Tax Office guidelines if you receive a lottery ticket in return for your transaction then your purchase cant be claimed as a deduction. If you receive a benefit from making a donation you can only deduct the amount of your donation that is greater than the value of the benefit you receive.

A of ACT 293466. All prizes will be donated by local businesses. In other words charities that sell raffle tickets items or food to raise money cannot benefit from tax-deductible gifts as they are not able to claim these deductions.

When you run a fundraising event such as a dinner or auction individuals who contribute to the event may be able to claim a portion of their contribution as a tax deduction. A of VIC 122529. No lottery tickets are not able to be claimed as a tax deduction.

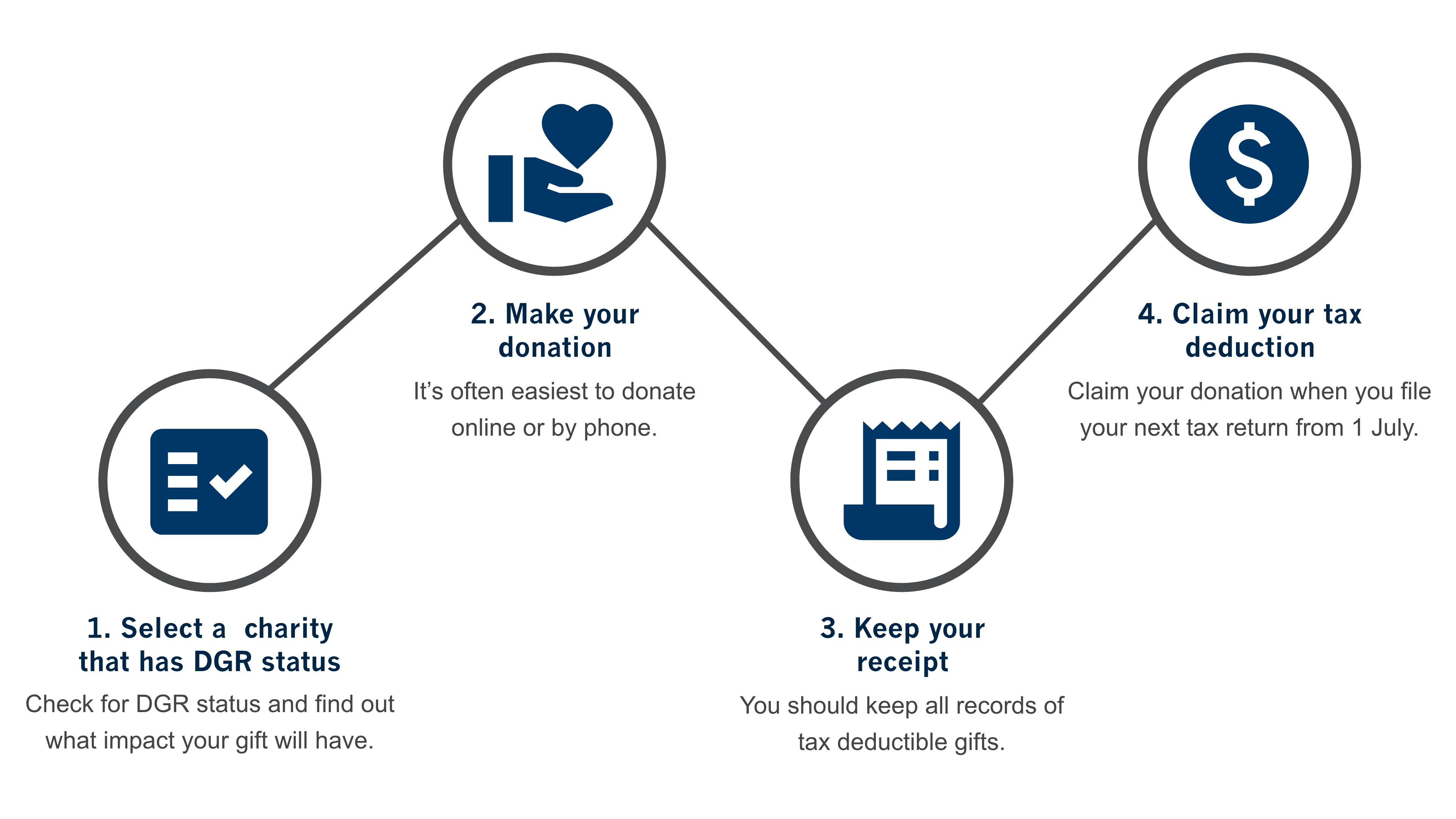

For a donation to be tax deductible it must be made to an organisation endorsed as a Deductible Gift Recipient DGR and must be a genuine gift you cannot receive any benefit from the donation. There is the chance of winning a prize. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status.

Any donation that meets this criteria is considered a tax deductible donation which means you can deduct the amount of your gift from your taxable income on your tax return. 3 donations you can claim on tax. We plan to run a raffle in order to raise funds.

You cant claim gifts or donations that provide you with a personal benefit such as. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status. However if you want to claim more than 10 you will need a.

In Australia raffles can only be run for the benefit of not-for-profit declared community or charitable organisations. This means that purchases from a charity that involve raffle tickets items or. Basically if you receive something because of your donation then dont claim the donation as a tax deduction.

Some donations to charity can be claimed as tax deductions on your individual tax return each year. Further conditions for a tax-deductible contribution. 230349 J of VIC.

GST and revenue on sale of raffle tickets - not for profit organisation in NSW. Items such as chocolates mugs keyrings hats or toys that have an advertised price. To qualify for a deduction the contribution must meet all the conditions for a tax deductible contribution.

To claim a deduction you must have a written record of your donation. C of ACT 718493. No-one wants to count all the change in all the charity tins but a report in 2018 found the average annual claim for tax deductible donations was 63372.

Raffle or art union tickets for example an RSL Art Union prize home. First of all if you receive a raffle ticket dinner attendance event entry chocolates or anything like that then your donation cant be claimed as a deduction. The IRS considers a raffle ticket to be a contribution from which you benefit.

Hi I am a bookkeeper for a small not for profit neighbourhood centre in NSW. Credit Card Bonus Winner. This is because the purchase of raffle tickets is not a donation i.

In Australia raffles can only be run for the benefit of not-for-profit declared community or charitable organisations. Thats averaging out claims by the likes.

Pin By Heather Dunn On Real Estate Info Competition Info

Picking A Good Charity To Donate To And Making The Most Of It With Your Tax Return Abc Everyday

How To Claim Tax Deductible Donations On Your Tax Return

2022 Golf Classic Raffle Northwest Community Healthcare

Are Raffle Tickets Tax Deductible The Finances Hub

Letter Requesting Donations For Silent Auction Download This Silent Auction Donation Reques Donation Letter Donation Letter Template Donation Request Letters

How To Claim A Tax Deduction On Christmas Gifts And Donations

Raffle Cheat Sheet A Tool That Helps Volunteers Sell More Raffle Tickets Fundraising Gala Auctioneer Sherry Truhlar Raffle Tickets Raffle Auction Fundraiser

Understanding Charity Donations And Tax Deductions Quickbooks

Ato Warns Of Common Tax Deduction 2 In 3 Get Wrong

Are Raffle Tickets Tax Deductible The Finances Hub

Common Tax Issues Associated With Making Donations Wolters Kluwer

Are Raffle Tickets Tax Deductible The Finances Hub

Dodgeball For The Arts Enter To Win A 2 Night Stay Plus 100 In Las Vegas Nv Kickball Party Kickball Tournament Dodgeball

Are Nonprofit Raffle Ticket Donations Tax Deductible

Tax Deductible Donations Reduce Your Income Tax The Smith Family